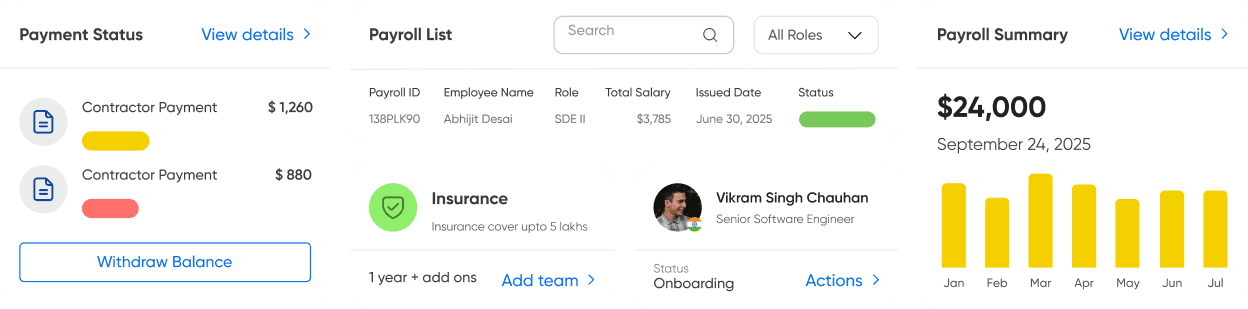

We handle payroll,

so you don’t have to

Hiring Indian talent shouldn't mean dealing with complex local compliance.

Seamless, compliant, stress-free payroll services in India

Our Payroll Services are designed to give you peace of mind while enabling your business to grow with the support of skilled Indian professionals.

When you partner with us, we take full responsibility for managing all aspects of payroll for your Indian hires — ensuring complete compliance with Indian labor laws, tax regulations, and statutory contributions.

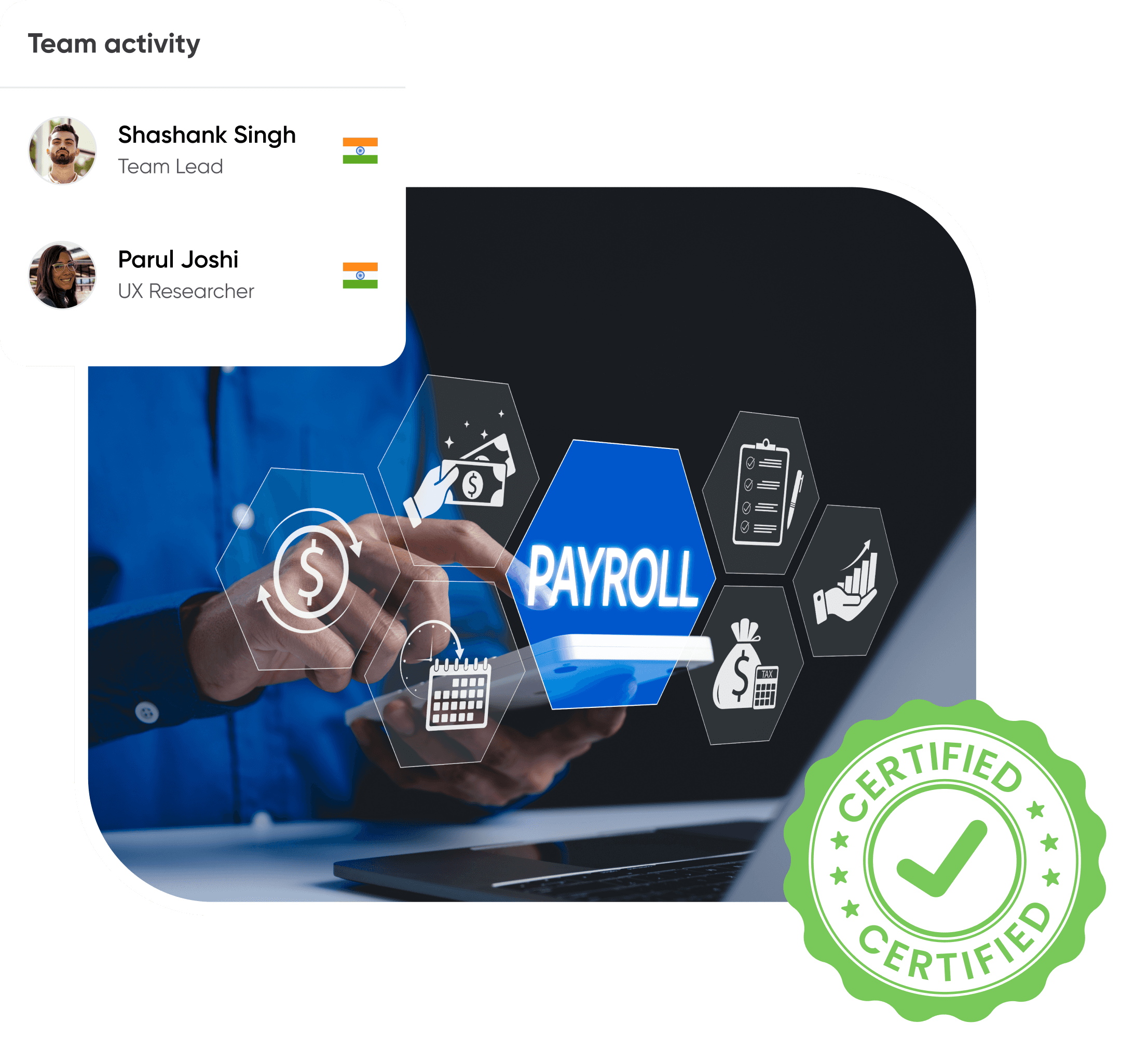

Our payroll services include

Accurate Payroll Processing

Timely and error-free salary disbursements, tax deductions, and compliance documentation.

Compliance Management

We ensure adherence to Indian labor laws, PF, ESI, gratuity, bonus, and other mandatory statutory requirements

Tax & Withholding

Calculation and filing of employee taxes, TDS, and other applicable withholdings, on your behalf

Employment Contracts

Legally compliant contracts that protect both employer and employee rights in accordance with Indian regulations

End-to-End Documentation

Provide compliant employment contracts, Offer letters, appointment letters, Form-16, tax documents, and any other paperwork required

Secure Payroll Infrastructure

We use robust systems that ensure data privacy, security, and transparency

Perfect for International companies hiring remote Indian professionals

Access tech, support, design, and more – without the need to set up a legal entity in India.

Ready to simplify payroll in India?

Let us handle the heavy lifting while you build your global team with confidence.